The latest on property, tax time, and BNPL changes!

We’ve got a few exciting updates to share with you this week — starting with a special invitation.

James has recorded a short video personally inviting you to our upcoming webinar. In it, he shares what the session will cover, why it’s so relevant right now, and what you’ll walk away with.

We’ve also been celebrating some client wins — Scott just locked in his second property and shared a proud moment by tagging us in his IG story. Take a look below!

On the finance front, here are a few updates to keep you in the loop:

- New Buy Now Pay Later (BNPL) regulations came into effect on 10 June 2025, bringing stricter oversight and stronger consumer protections. We’ve included a quick summary below with a link to learn more.

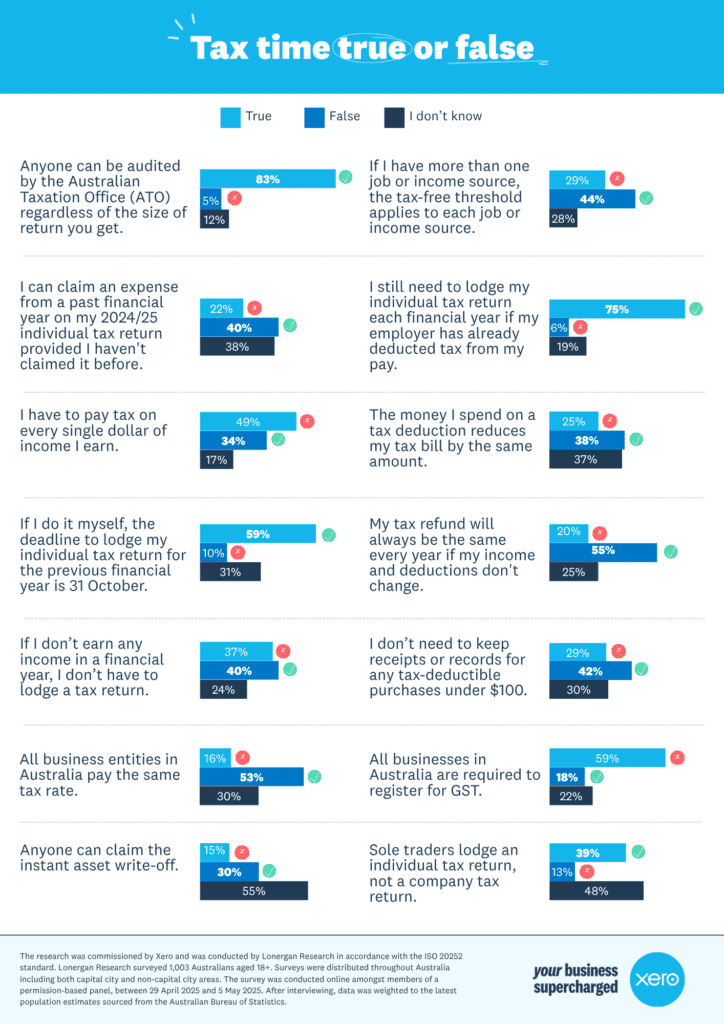

- And with tax time fast approaching, a recent Xero survey reveals that many Australians are still unsure about what’s true and what’s myth when it comes to their returns. We’ve included the key stats and insights in the graph below.

Congratulations, Scott!

One of our dear clients, Scott, is now officially a two-property owner — and feeling the pride that comes with smart investing.

We couldn’t be more thrilled to see our clients reaching their goals and feeling this level of pride and confidence. Big cheers to Scott’s success! 🍸

Tax Time True or False

Tax time comes around every year — but that doesn’t mean everyone’s got it figured out. A recent Xero survey shows many Aussies are still unsure about what’s fact, what’s outdated, and what’s just plain myth. (Source: Xero Blog)

New Buy Now Pay Later Regulations

Changes to the way Buy Now Pay Later services are regulated came into effect on 10 June, strengthening protections for consumers and aligning BNPL with products such as credit cards.

BNPL providers now need to hold an ACL, be a member of AFCA, and meet certain responsible lending and credit reporting obligations, with facilities over $2,000 required to include credit reporting. (Source: MFAA)

Got big property goals but you’re not sure where to start – or what comes next?

You’re not alone. Whether it’s your first home or your next investment, getting started can feel overwhelming. But with the right guidance, you can go from stuck to confident — and we’re here to help.